Climate-scenario modeling is an important tool used by financial services to investigate how different combinations of risks could impact the future solvency of a financial entity and what action could […]

A panel discussion examining the market and business challenges, and potential solutions, to limit the spread of misinformation on social media. HOSTED BY Curt Nickisch (QST'13) Senior Editor and […]

Misinformation has been a problem for all of human history, but is particularly challenging to control on today’s social media platforms. Under the current US Section 230 regulation, internet companies […]

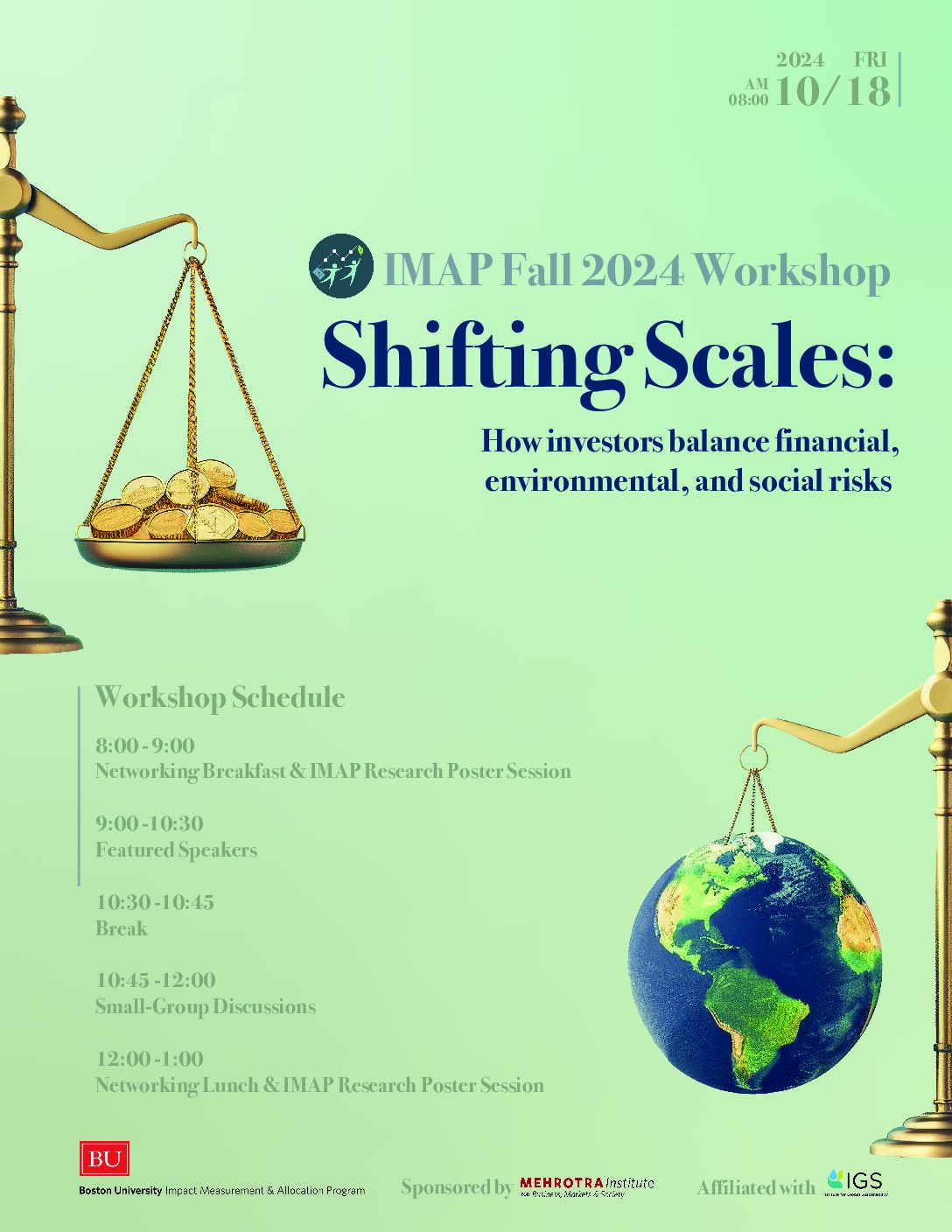

The Impact Measurement & Allocation Program (IMAP)'s 3rd annual Fall Workshop will take place on Friday, October 18, 2024, from 8 am – 1 pm on the Boston University campus. […]

Professor Eddie Riedl discussed his paper outlining a novel approach to assessing business climate transition risk: i.e., the risks to firms in a transition to a low carbon economy. Prior […]

Replications of five of the most important ESG studies have uncovered evidence challenging their methods, logic, or findings. More replications and analyses are ongoing. Professor Andy King will describe his […]

The Investment Tax Credit (“ITC”) is an essential part of U.S. policymakers’ strategy to encourage investment in clean energy. We investigate the effect of Investment Tax Credits on firms’ electricity […]

Geospatial finance combines cutting-edge geospatial data from satellites, drones, and IoT sensors with AI and cloud computing to deliver powerful ESG insights. This emerging field helps evaluate the environmental impact […]

Join leading international academics, practitioners and South African asset owners on March 17, 2025 as we launch a groundbreaking initiative to transform how institutional investors can optimise their investment impact. […]