Climate-scenario modeling is an important tool used by financial services to investigate how different combinations of risks could impact the future solvency of a financial entity and what action could be taken to mitigate those risks. Our research shows that current climate-scenario modeling excludes many of the most severe impacts we can expect from climate […]

A panel discussion examining the market and business challenges, and potential solutions, to limit the spread of misinformation on social media. HOSTED BY Curt Nickisch (QST'13) Senior Editor and Co-host, Harvard Business Review IdeaCast PANELISTS Nadine Strossen Professor of Law, New York Law School Past President of ACLU Mike Masnick CEO and […]

Misinformation has been a problem for all of human history, but is particularly challenging to control on today’s social media platforms. Under the current US Section 230 regulation, internet companies are not held responsible for the content shared on their platforms. Other countries have taken different approaches to regulation. With a shared goal to maintain […]

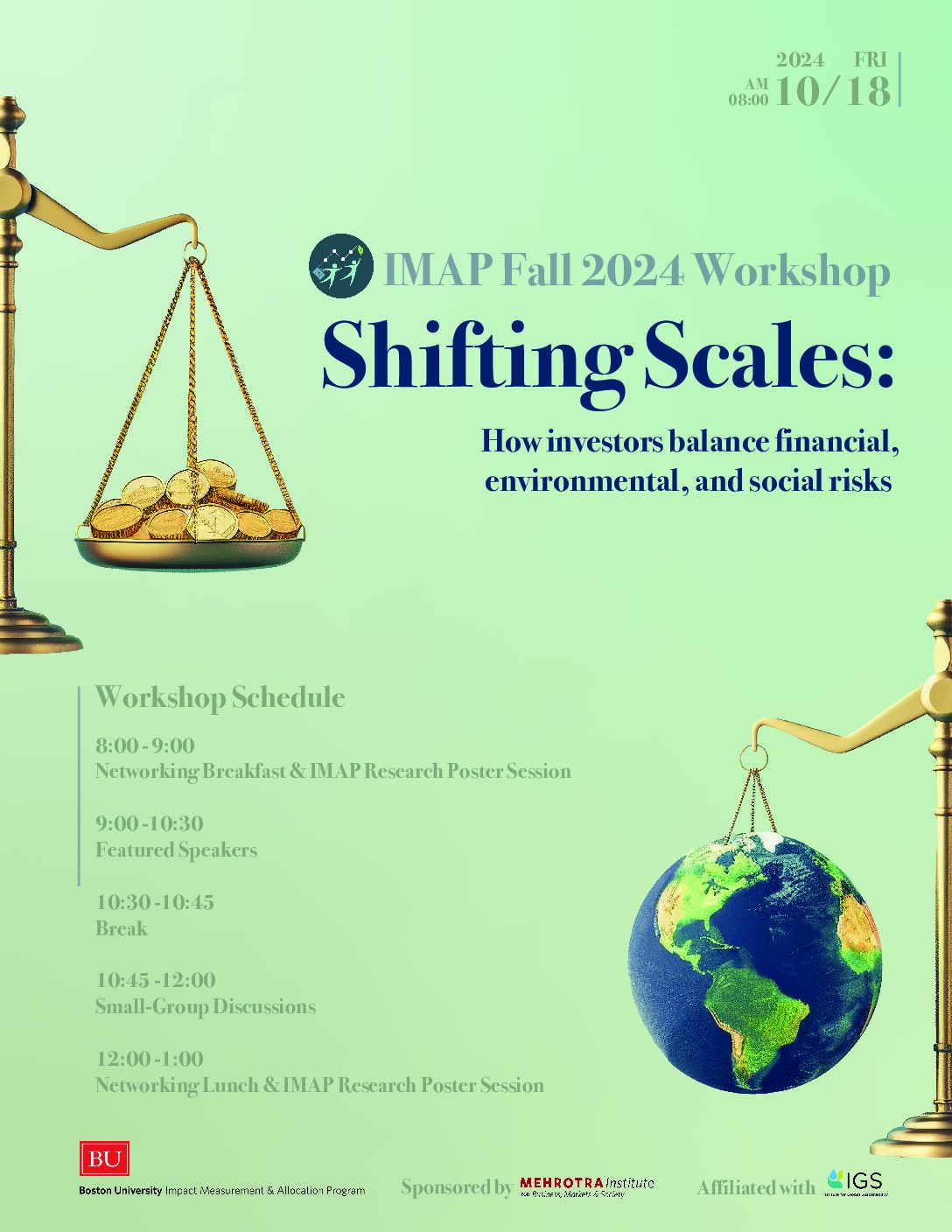

The Impact Measurement & Allocation Program (IMAP)'s 3rd annual Fall Workshop will take place on Friday, October 18, 2024, from 8 am – 1 pm on the Boston University campus. Schedule: 8:00 – 9:00 am – Breakfast + Poster Session 9:00 am – 12:00 pm – Presentation + Panel Discussion + Breakout Room Discussions 12:00 […]

Professor Eddie Riedl discussed his paper outlining a novel approach to assessing business climate transition risk: i.e., the risks to firms in a transition to a low carbon economy. Prior work considers transition risk primarily through the lens of negative outcomes, such as increased costs due to more regulated carbon emissions. This paper takes an […]

Replications of five of the most important ESG studies have uncovered evidence challenging their methods, logic, or findings. More replications and analyses are ongoing. Professor Andy King will describe his replication of “The Impact of Corporate Sustainability on Organizational Processes and Performance,” by Eccles, Ioannou, and Serafeim. He will also discuss the status of replications […]

The Investment Tax Credit (“ITC”) is an essential part of U.S. policymakers’ strategy to encourage investment in clean energy. We investigate the effect of Investment Tax Credits on firms’ electricity generation and emissions with a sample of electric utilities from 2001-2022. Using a stacked cohort difference-in-differences design, we find that firms generate less electricity from […]

Geospatial finance combines cutting-edge geospatial data from satellites, drones, and IoT sensors with AI and cloud computing to deliver powerful ESG insights. This emerging field helps evaluate the environmental impact of corporate actions, uncover sustainable investment opportunities, and enhance climate risk analysis. By transforming regulatory reporting and sustainability assessments, geospatial finance is shaping the future […]

Join leading international academics, practitioners and South African asset owners on March 17, 2025 as we launch a groundbreaking initiative to transform how institutional investors can optimise their investment impact. Our very own Nalin Kulatilaka, Professor of Finance at Boston University Questrom School of Business will be participating and speaking at the event. See […]